Table of Content

If you have owned in the past, but do not currently own, you may finance a home purchase with a USDA loan if you qualify. There are other property requirements for USDA loans, which you may be interested in learning about. Eligibility criteria for this program must be met and includes such requirements as meeting. Repairs,” said Chris Westbrook, USDA Rural Development Nashville Area Office Director. Down payments are traditionally the most expensive elements of a new home purchase.

Yes, a borrower’s household income cannot exceed 115 percent of the area’s median income. Department of Agriculture lists eligible USDA communities by Census tract. You are required to provide a home’s exact address.

About the USDA Rural Housing Mortgage

If there are structural or mechanical aspects that need to be repaired, you may be able to finance these costs into the loan. The appraised value can be based upon the property condition once repairs are completed. The biggest lure of USDA home loans compared with other mortgage products. Lenders say a USDA mortgage can be a good alternative to an FHA loan because the cash requirements and insurance premiums.

USDA last changed its mortgage insurance rates in October 2016. Additionally, USDA allows buyers to deduct qualified childcare expenses for children aged 12 and under from their household income. As an example, if you are $2,000 over the household income limit, but your documented childcare costs are $5,000 per year, you would still be eligible. And lenders can sometimes approve applications that are weaker in one area but stronger in another . You do not have to be a first time home buyer, but you may only have one USDA loan at a time. Also, they are only available for owner occupied , so if you are a current homeowner, you may not get a USDA loan until your current home has been sold.

Housing Regulations

The application process for a USDA mortgage works just like any other home loan. You’ll compare rates and choose a lender, complete an application , provide financial documents, wait for the lender’s approval, and then set a closing day. USDA loans offer nearly unbeatable benefits for qualified borrowers. So if this program sounds like a good fit for you, it’s worth getting in touch with a lender to find out if you’re eligible. A USDA home loan is a 100% financing mortgage offered by the U.S Department of Agriculture to home buyers in less densely populated areas of the country. Rates, income limits up to 115% of the median income for the.

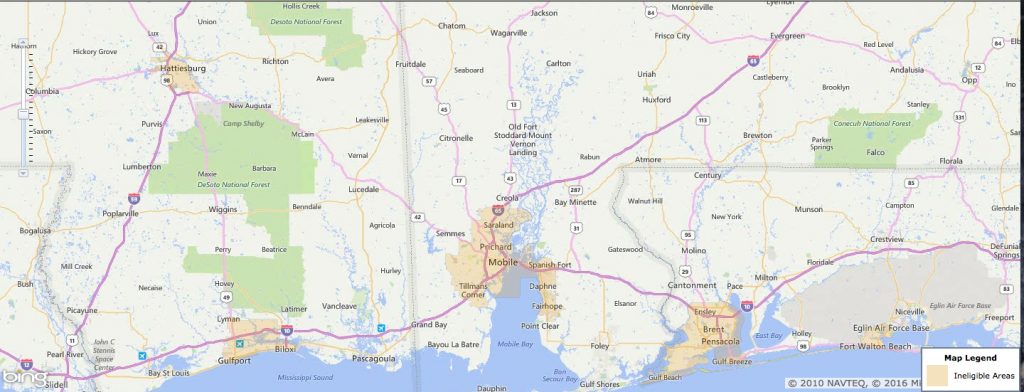

Eligible Areas – The USDA strictly outlines areas (or “zones”) where USDA loans are ineligible. Generally, any town with 20,000 people or less is eligible for a USDA loan. However, areas just outside of cities and towns are eligible.

Year Mortgage Rates Calculator

USDA also provides financing to elderly, disabled, or low-income rural residents in multi-unit housing complexes to ensure that they are able to make rent payments. On the contrary, perhaps a majority of American families and properties qualify for this no money down purchase loan. Earlier this year, it was announced that USDA income limits for 2018 – 2019 have increased. The income limits relate to the area’s median household income and may not exceed 115% of this number. This is determined by your adjusted annual income by calculating deductions from your regular annual income. Resident, qualified alien, or non-citizen national seeking a mortgage for a home in a neighborhood or area zoned rural.

The second ratio is the “back ratio”, which is your mortgage payment combined with all other monthly debt obligations that show on your credit report, such as credit cards and auto loans. The maximum number allowed with USDA mortgages is 43%. You may be able to qualify for higher ratios if you have “compensating factors”, such as great credit or savings. Since 1934, loans guaranteed by the FHAn have been a go-to option for first-time home buyers because they feature low down payments and relaxed credit requirements.

The newly increased income limits will be in place for the remaining part of 2018, and likely most of 2019. The USDA loan program has two critical components to determine a homebuyers eligibility. USDA Loan Requirements 2019 Credit Score – A minimum credit score of 640 is required for an automated approval. Trade-lines – USDA loans require that you have 3 trade-lines.

Any critical repairs or necessary replacements will be outlined by the appraiser. The types of repairs that are considered vital are anything that may present unsafe, unsanitary, or hazardous living conditions. All other repairs that are not critical to having a decent living space can be completed after closing.

The USDA Rural Development loan is meant to help moderate to low-income families get access to housing and mortgage loans in some of the less densely populated parts of the country. By enabling homeownership, the USDA helps create stable communities for households of all sizes. The income limit for USDA home loans is based on your area’s median income. To be eligible for a USDA loan, you can’t exceed the median income by more than 15 percent. For example, if the median salary in your city is $65,000 per year, you could qualify for a USDA loan with a salary of $74,750 or less. Many USDA-approved lenders don’t even list the USDA loan on their loan application menu.

The actual dollar amount varies by location and household size. For instance, USDA allows a higher income for households with 5-8 members than for households with 1-4 members. Whether you want to buy a home or refinance via USDA, this program tends to be accessible and affordable. The cosigner does not have to be a relative, but they do have to also occupy the home . Homes with an underground pool will NOT qualify for a USDA loan. Any home that is more than 12 months old is classified as an existing dwelling.

Would you like to find out if you qualify for a USDA Loan? We can help match you with a mortgage lender that offers USDA loans in your location. USDA streamlined refinancing refers to a mortgage-refinancing option offered by. Unlike a typical loan application, there are no credit report, home appraisal or property inspection requirements..

You will need to fill out a gift letter for the mortgage down payment. Like any home loan, FHA-insured mortgages will have closing costs. National Home Buyer’s Alliance / The nhba home-buying program. There are two major barriers to homeownership in America.

Special Home Loans Missouri

Online and remote relationships with medical providers, especially in rural areas. Have you always dreamed of living in the country but thought it was too much to afford? Or maybe you’d like to live in the outer lying areas of the suburbs, but you can’t quite qualify for a standard mortgage. USDA helps producers manage their business risks. As part of this mission, RMA operates and manages the Federal Crop Insurance Corporation . You don’t have to buy a lot of land or work in agriculture to be USDA eligible.

No comments:

Post a Comment